Join us on an intriguing journey into the world of finance with our captivating Use a Debit Card Crossword. Dive into a realm of knowledge where you’ll unravel the intricacies of debit cards, from their basics to their benefits and beyond.

Get ready to challenge your financial acumen and embark on a thought-provoking adventure.

This comprehensive guide will illuminate the nuances of debit cards, empowering you to make informed decisions and navigate the financial landscape with confidence. Whether you’re a seasoned cardholder or just starting to explore the world of plastic, this crossword will engage and educate you.

Debit Card Basics

A debit card is a payment card that deducts money directly from a consumer’s checking account when making purchases or paying for services.

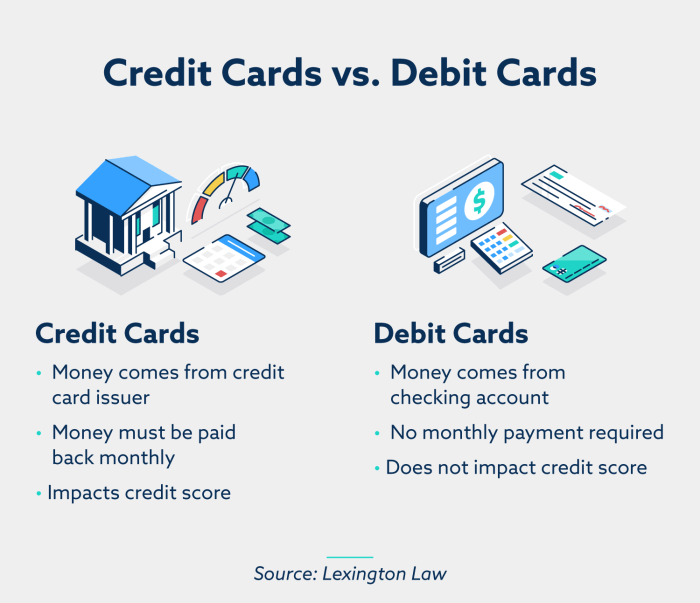

Unlike credit cards, debit cards do not allow users to borrow money. Instead, they allow access to funds that are already available in the linked checking account. This makes debit cards a convenient and secure way to make purchases without incurring debt.

To solve the “use a debit card” crossword puzzle, you need to think about how you use your debit card in everyday life. For example, you might use it to make purchases at the grocery store or to pay for gas.

Once you have a few ideas, you can start to fill in the crossword puzzle. If you’re stuck, you can check out the training level test 1 2023 for some tips. With a little practice, you’ll be able to solve even the most challenging crossword puzzles.

Transactions with Debit Cards

Debit cards can be used to make a wide range of transactions, including:

- Purchasing goods and services in stores, online, or over the phone

- Withdrawing cash from ATMs

- Paying bills online or through a bank’s bill pay service

- Transferring funds between accounts

Using a Debit Card: Use A Debit Card Crossword

Debit cards offer a convenient way to make purchases and manage your finances. However, it’s important to use them safely and securely to avoid potential risks.

When using a debit card, always keep the following tips in mind:

- Keep your PIN secret and never share it with anyone.

- Be aware of your surroundings when using your card at an ATM or point-of-sale terminal.

- Check your account statements regularly for unauthorized transactions.

- Report any lost or stolen cards immediately to your bank.

Benefits of Using a Debit Card, Use a debit card crossword

Debit cards offer several benefits, including:

- Convenience:Debit cards allow you to make purchases without carrying cash.

- Security:Debit cards are generally more secure than cash or checks, as they can be canceled if lost or stolen.

- Tracking:Debit card transactions are recorded on your account statements, making it easy to track your spending.

- Rewards:Some debit cards offer rewards programs that allow you to earn points or cash back on purchases.

Drawbacks of Using a Debit Card

There are also some potential drawbacks to using a debit card, including:

- Overdraft fees:If you spend more money than you have in your account, you may be charged an overdraft fee.

- Transaction fees:Some banks charge a fee for each debit card transaction.

- Limited acceptance:Debit cards are not accepted everywhere, especially in smaller businesses.

- Fraud:Debit cards can be used fraudulently if they are lost or stolen.

How to Activate and Use a Debit Card

To activate your debit card, you will need to contact your bank and follow their instructions. Once your card is activated, you can use it to make purchases at any point-of-sale terminal or ATM that accepts debit cards.

To use your debit card, simply insert it into the card reader and enter your PIN. You may also be asked to sign a receipt for the transaction.

Debit Card Fees

Debit cards are a convenient way to make purchases, but they can also come with fees. It’s important to be aware of these fees so that you can avoid or minimize them.

There are a few different types of fees that can be associated with debit cards. These include:

- Monthly maintenance fees: Some banks charge a monthly fee for debit card accounts. These fees can range from $5 to $15 per month.

- Transaction fees: Some banks charge a fee for each transaction you make with your debit card. These fees can range from $0.25 to $1.00 per transaction.

- Overdraft fees: If you spend more money than you have in your account, your bank may charge you an overdraft fee. These fees can range from $25 to $35 per overdraft.

There are a few things you can do to avoid or minimize debit card fees. These include:

- Choose a bank that doesn’t charge monthly maintenance fees or transaction fees.

- Use your debit card only for purchases that you can afford.

- Set up overdraft protection so that you don’t incur overdraft fees.

The following table compares the fees of different debit cards:

| Bank | Monthly maintenance fee | Transaction fee | Overdraft fee |

|---|---|---|---|

| Bank of America | $0 | $0.25 | $25 |

| Chase | $0 | $0.25 | $35 |

| Wells Fargo | $5 | $0.50 | $25 |

Debit Card Security

Debit cards offer convenience, but they also come with potential security risks. Understanding the security features and risks associated with debit cards is crucial for protecting your financial information and avoiding fraud.

Debit cards typically come with various security features, including:

- Chip technology:Embedded microchips generate unique transaction codes for each purchase, making it harder for fraudsters to duplicate cards.

- PIN (Personal Identification Number):A secret code required for certain transactions, providing an extra layer of protection.

- Magnetic stripe:Stores your card information, but it is becoming less secure due to advancements in card skimming technology.

Risks Associated with Debit Cards

Despite these security features, debit cards can still be vulnerable to fraud:

- Card skimming:Fraudsters use devices to capture card information from ATMs or gas stations.

- Phishing:Scammers send emails or text messages that appear legitimate, tricking you into revealing your card details.

- Identity theft:Fraudsters may obtain your personal information through data breaches or other means and use it to access your debit card account.

Protecting Yourself from Debit Card Fraud

To minimize the risks associated with debit cards, follow these tips:

- Monitor your account regularly:Check your account statements and online banking frequently for any unauthorized transactions.

- Use strong PINs:Avoid using simple or predictable PINs that can be easily guessed.

- Be cautious of card readers:Inspect ATMs or card readers before using them and avoid those that look suspicious.

- Report lost or stolen cards immediately:Contact your bank or credit union to report any lost or stolen cards and freeze your account.

Debit Card Alternatives

Debit cards are a convenient way to make purchases and access cash, but they’re not the only option. There are a number of alternative payment methods that offer their own advantages and disadvantages.

Here are some of the most popular debit card alternatives:

Cash

Cash is the most basic form of payment and is still widely accepted. It’s anonymous, so you don’t have to worry about your financial information being compromised. However, cash can be easily lost or stolen, and it’s not always convenient to carry around large amounts of money.

Checks

Checks are a more secure way to pay than cash, but they can take longer to process. You also need to have a checking account in order to use checks.

Credit Cards

Credit cards allow you to borrow money to make purchases. You can then pay back the money over time, usually with interest. Credit cards offer a number of advantages, such as rewards points, purchase protection, and extended warranties. However, it’s important to use credit cards responsibly and avoid carrying a balance, as interest charges can add up quickly.

Prepaid Cards

Prepaid cards are similar to debit cards, but they are not linked to a checking account. Instead, you load money onto the card before you use it. Prepaid cards are a good option for people who want to control their spending or who don’t have a checking account.

Mobile Payments

Mobile payments allow you to make purchases using your smartphone. There are a number of different mobile payment apps available, such as Apple Pay, Google Pay, and Samsung Pay. Mobile payments are convenient and secure, but they require you to have a smartphone and a compatible payment app.

The following table compares debit cards to other payment methods:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Debit Card | – Convenient

|

– Can be used to overdraft your account

|

| Cash | – Anonymous

|

– Can be easily lost or stolen

|

| Checks | – More secure than cash

|

– Can take longer to process

|

| Credit Card | – Rewards points

|

– Interest charges can add up quickly

|

| Prepaid Card | – Good for controlling spending

|

– May have fees

|

| Mobile Payments | – Convenient

|

– Require a smartphone and a compatible payment app

|

Question Bank

What is the primary difference between a debit card and a credit card?

Debit cards deduct funds directly from your bank account, while credit cards allow you to borrow money up to a set limit.

What are the advantages of using a debit card?

Debit cards offer convenience, security, and the ability to track your spending more effectively.

What are some tips for using a debit card safely?

Protect your PIN, be aware of your surroundings when using your card, and monitor your account statements regularly for any unauthorized transactions.